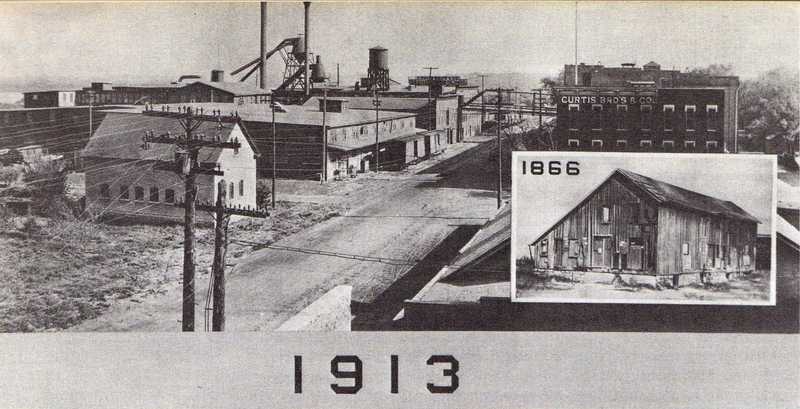

Curtis Bros. Offer Sick and Accident Benefits - 1913

From: The Clinton Herald; July 15, 1913

Transcribed by a Clinton County IaGenWeb volunteer.

CURTIS BROS & CO. OFFER PLAN FOR SICK AND ACCIDENT BENEFITS

ADVANCED PROPOSITION FOR PENSIONS AND BENEFITS PROPOSED TO EMPLOYEES.

PROVIDE TWO FUNDS.

Company to Maintain Entirely Fund for Accident Benefits and pensions and to

Contribute to Insurance Against Sickness and Death From Ordinary Causes.

Subject to the acceptance by at least 60 per cent of the employees, Curtis Bros.

& Co. of Clinton and allied companies, today offered to employees what is

declared to be the most advanced plan for pensions, sick and accident benefits

ever proposed by any employer. Provision is made for two separate departments,

the companies to maintain entirely that devoted to the payment of pensions and

accident benefits and indemnities, while the employees who come under the plan

will contribute to the sick benefit fund, the companies also contributing

liberally to that fund.

Subject to the acceptance by at least 60 per cent of the employees, Curtis Bros.

& Co. of Clinton and allied companies, today offered to employees what is

declared to be the most advanced plan for pensions, sick and accident benefits

ever proposed by any employer. Provision is made for two separate departments,

the companies to maintain entirely that devoted to the payment of pensions and

accident benefits and indemnities, while the employees who come under the plan

will contribute to the sick benefit fund, the companies also contributing

liberally to that fund.

It is the aim of the companies to cover every possible case of disability that

could occur to employees, either in or out of the factory. The scheme conforms

with and improves upon the Iowa law, which does not go into effect for a year,

although the Curtis Bros. & Co. plan will become effective this year if the

employees take kindly to it. Employees receiving benefits under the accident or

sick provisions will not be deprived of their rights to a pension but at

retirement age will be given a pension as though they had been actively employed

all of the time.

The Clinton company, headquarters for all the other companies has made the

following announcement:

The Curtis Bros. & Co. of this city, has made provision, together with all the

Curtis companies situated at other points, for a system of retirement pensions

for old employees, the security of the payment of compensation to all employees

injured by accident and to the families of all employees dying as the result of

injuries by accident and for the support of employees disabled by sickness and

for their families in event of death. It is believed to be the most complete and

comprehensive provision of the character that has so far been made in this

country and the most highly beneficial for employees. The ideal which is aimed

at is that no person who remains in the employment of the Curtis companies shall

by reason of his death, whether due to accident or to ordinary causes, become an

object of charity.

The retirement pensions for aged employees and all compensation for accidents

occurring while at work are to be provided for solely out of the funds of the

company. Toward the funds which will supply support for employees disabled by

sickness and of the families of employees dying as the result of ordinary causes

the employees will be expected to contribute and they will also have a voice in

the management of these funds and the adjustment of such claims. The company

will also contribute to these funds liberally in addition to providing the life

pensions and compensation for all accidents occurring while at work.

Retirement Pensions.

The retirement pensions will be 1 percent of the wages for each year of service,

so that if an employee is earning $20 per week and has served the company for 35

years he would , upon reaching the retirement age, be entitled to a pension of

$7 a week or $364 a year so long as he lives. The retirement age for women is 60

years, and for men 70 years; and the minimum period entitling to pension will,

for employees hereafter admitted, be 20 years’ service, but existing employees

may enter upon it if they have been ten years or more in the service and will

receive a minimum pension of 20 percent of the wages, even though only ten years

in the service.

The retirement pensions will be 1 percent of the wages for each year of service,

so that if an employee is earning $20 per week and has served the company for 35

years he would , upon reaching the retirement age, be entitled to a pension of

$7 a week or $364 a year so long as he lives. The retirement age for women is 60

years, and for men 70 years; and the minimum period entitling to pension will,

for employees hereafter admitted, be 20 years’ service, but existing employees

may enter upon it if they have been ten years or more in the service and will

receive a minimum pension of 20 percent of the wages, even though only ten years

in the service.

Accident Compensation.

The compensation for accidents will be in accordance with the state law. The

state of Iowa has recently passed a law which does not go into effect, however,

until July of next year and even then will not apply to this company unless it

elects to go under it, nor to any one of its employees if he elects not to go

under it, which, if the company does so elect, provides for payment of

compensation by the company, in the event of the injury or the death of an

employee, due to accident, while at work, as follows:

Total disablement; due to accident while at work.

First two weeks, medical treatment only.

After two weeks: If temporary, half wages (but not more than$10.00 nor less than

$5.00) during disability but not longer than 300 weeks; If permanent, same, but

limited to 400 weeks instead of 300.

Partial disablement; due to accident while at work:

Proportionate; but, instead, fixed terms and amounts for certain injuries, such

as: loss of thumb, 50 percent for 40 weeks; of first finger, 30 weeks; of hand,

150 weeks; arm, 200 weeks; foot, 125 weeks; eye, 100 weeks.

Death, due to accident while at work: $100 for last sickness and burial expense.

Half wages (not more than $10 nor less than $5) to all persons wholly dependent,

for not to exceed 300 weeks. Proportionate part of half wages to persons

partially dependent, if none wholly dependent, for not to exceed 300 weeks.

Death, due to accident while at work: $100 for last sickness and burial expense.

Half wages (not more than $10 nor less than $5) to all persons wholly dependent,

for not to exceed 300 weeks. Proportionate part of half wages to persons

partially dependent, if none wholly dependent, for not to exceed 300 weeks.

While this law does not go into effect until July, 1914, and only then if the

company elects to go under it, Curtis Bros. & Co., have decided not to wait

until July, 1914, but to carry out the provisions of it as soon as the benefit

department is in operation.

To secure the payment of this compensation, all of the Curtis companies have set

up a trust fund supported entirely by their contributions and to be held and

invested exclusively for the security of the payments of the compensation and to

be kept at all times solvent and able to take care of all compensation payments

as certified by a competent insurance actuary who is to make a valuation every

year.

Disabled by Sickness.

The benefits to employees disabled by sickness are 50 per cent of their wages

after the first week. The services of a physician and medicines are also

provided, and if it should be necessary, hospital and surgical attendance,

likewise.

If only partially disabled, no allowance is made if the impairment of earning

power is 20 per cent of wages or less; but if more than 20 percent, half the

amount of impairment is granted.

If only partially disabled, no allowance is made if the impairment of earning

power is 20 per cent of wages or less; but if more than 20 percent, half the

amount of impairment is granted.

The benefits cease at the retirement age, that is, 60 for a woman, and 70 for a

man, at which time a pension is allowed the same in amount as if the employee

were in the service of the company and had been in the service all through the

term of disability.

The benefit to the family in event of death of the employee due to ordinary

causes is the payment of actual funeral and burial expenses, not exceeding $100

with 30 per cent of the wages to the wife during her widowhood, and a special

and final payment upon her remarriage equal to three times the annual payment;

and also 15 per cent of the wages to one child under 16, and 20 per cent of the

wages for two or more children under 16; while if the wife does not survive her

husband, the provision for one child is increased to 20 per cent of the wages;

and if two or more, to 40 per cent of the wages; and if there is neither wife

nor child, two years’ wages is paid in one sum to the next of kin.

These payments for disability and death due to ordinary causes are made from the

benefit fund to which both the companies and the employees contribute. The

contribution of the employees is fixed at 3 per cent of the wages, which cannot

be increased but may be diminished if there should be a surplus in the fund.

Company’s Contributions.

Company’s Contributions.

The company’s contributions are as follows:

1. The entire cost of the retirement pensions.

2. The entire cost of all compensation paid to employees injured by accident

occurring while at work and to the families of employees dying as a result of

such accident.

3. One per cent of the entire payroll to the benefit fund.

4. All the expenses of management of all the departments.

5. Whatever sum or sums may from time to time be necessary to cover any

deficiency in the benefit fund, which advances, however, may be made good out of

surplus thereafter arising.

The plans, the scale of benefits and the contributions required were computed by

Miles M. Dawson, a consulting actuary of New York, who was Mr. Hughes’ assistant

in the famous “Armstrong committee” investigation of the life insurance

companies some years ago, and who has devoted much study and attention to the

subject of benefit funds, serviced pensions and workmen’s compensation and has

assisted to institute similar plans that are in successful operation in

different parts of the country.

His estimate is that by the time the plans are in full operation, the companies’

contributions will amount to more than twice as much as the contributions by the

employees.

Cannot Be Diverted.

None of the contributions by the

employees may be diverted from the benefit

department or in any way relieve the company from payment of retirement pensions

or compensation for accident or the fixed contributions called for by their

agreement. Surplus arising in the benefit fund can be applied only to increase

the benefits or reduce the contributions of employees.

None of the contributions by the

employees may be diverted from the benefit

department or in any way relieve the company from payment of retirement pensions

or compensation for accident or the fixed contributions called for by their

agreement. Surplus arising in the benefit fund can be applied only to increase

the benefits or reduce the contributions of employees.

The management of the benefit fund at the plant in this city is to be entrusted

to an operating committee of three, one elected each year by the employees who

become members, one appointed by the company from among its employees, and one

(an officer or supervising employee) appointed by the president of the benefit

department. These will have power to adjust all claims, employ physicians,

arrange for medicines, hospital service, operations, medical and surgical

appliances and he like, and to pay all claims and expenses; and the payments of

pensions and of compensation for accidents will also be made through this

operating committee, but out of funds contributed by the company only.

Important Features.

Important features in connection with the plan are that it will not be necessary

to release the company from any obligation or liability for an accident, in

order to claim from the benefit department. The receipt given will merely

provide that in case compensation, indemnity or damages for an accident should

thereafter be collected, the benefits drawn from the benefit department are to

be deducted and returned to it.

Important features in connection with the plan are that it will not be necessary

to release the company from any obligation or liability for an accident, in

order to claim from the benefit department. The receipt given will merely

provide that in case compensation, indemnity or damages for an accident should

thereafter be collected, the benefits drawn from the benefit department are to

be deducted and returned to it.

Another very important feature is that after an employee shall have received his

compensation for the full period provided by the law or by the provisions of the

trust fund set up by the

companies for any disability due to an accident

occurring while at work, he shall therefore, if still disabled, be entitled to

benefit from the benefit fund during the continuance of the disability until he

reach the retirement age, when a pension will be given precisely as if he had

been in the service all the time; and in like manner, if compensation to a widow

or other dependent shall have been paid because of the death of an employee due

to an accident occurring while at work, for the full period required by law, or

provided for by compensation agreement between the companies, payment will

thereafter be made during the continuance of the widowhood or until the child

becomes 16 years of age, by the benefit department. In other words, the

provision made by the Curtis companies is much more liberal than any

compensation law, and is intended to and does make provision for the support of

aged or disabled employees and of the families of deceased employees throughout

the entire period of their need as measured by disability, widowhood or the

period of education for children.

companies for any disability due to an accident

occurring while at work, he shall therefore, if still disabled, be entitled to

benefit from the benefit fund during the continuance of the disability until he

reach the retirement age, when a pension will be given precisely as if he had

been in the service all the time; and in like manner, if compensation to a widow

or other dependent shall have been paid because of the death of an employee due

to an accident occurring while at work, for the full period required by law, or

provided for by compensation agreement between the companies, payment will

thereafter be made during the continuance of the widowhood or until the child

becomes 16 years of age, by the benefit department. In other words, the

provision made by the Curtis companies is much more liberal than any

compensation law, and is intended to and does make provision for the support of

aged or disabled employees and of the families of deceased employees throughout

the entire period of their need as measured by disability, widowhood or the

period of education for children.